As we enter the fourth quarter of 2023, this is a good time to pause and think about any changes in the tax code or in our lives that may have an impact on this year’s tax return. The pandemic-related changes to tax credits and stimulus payments that we saw over the past few years have largely gone away and the tax landscape is similar to what it was in 2019. However, most of the tax planning strategies that we can control need action before year-end, and there are some updates and changes to consider.

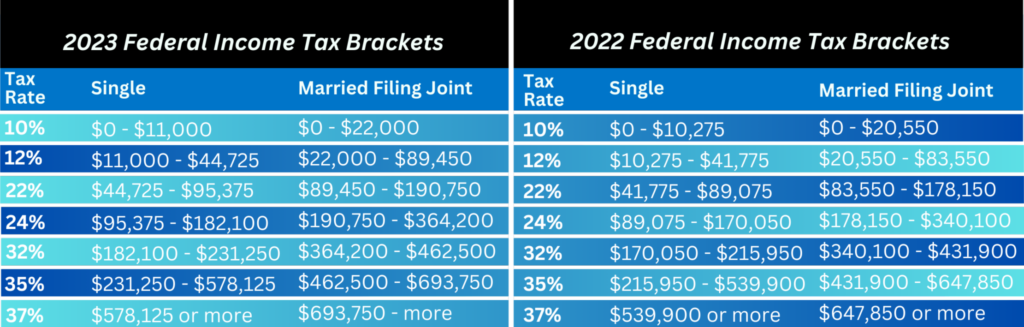

Tax Brackets

Tax rates have not changed in 2023; however, the income tax brackets are broader than they were in 2022. Due to high inflation, the upper limits of the brackets have increased substantially for 2023. For some taxpayers whose income has not increased much, they may find themselves in a lower tax bracket. Similarly, the capital gains tax rates have not changed, but the income thresholds used to determine the rate (0%, 15% or 20%) were adjusted for inflation.

Standard Deduction

The IRS adjusts the standard deduction each year, so due to high inflation, the increase from 2022 to 2023 is significant. In 2021 for a single taxpayer, the standard deduction was $12,550 (up $150 from 2020). For 2022, it went up $400 to $12,950 and for 2023 it is going up $900 to $13,850. Additional amounts are added to the standard deduction for taxpayers over age 65 and for blind taxpayers. Taxpayers who can be claimed as a dependent on someone else’s return have limited deductions.

IRA Distributions

The SECURE 2.0 Act significantly changed retirement account rules. While there are many nuances and details to consider, the highlights include the age to start taking Required Minimum Distributions (RMDs) increases to age 73 starting in 2023, and to age 75 in 2033. Starting in 2024, RMDs from Roth accounts inside of employer retirement plans will no longer be required. Starting in 2025, additional catch-up contributions will be available to certain taxpayers aged 60 – 63. Also starting in 2023, the penalties for failing to take an RMD will decrease from 50% to 25% of the RMD amount and will be further reduced to 10% for IRA distributions corrected in a timely manner.

While we wait for the final regulations from the IRS on RMDs for inherited IRAs, the proposed regulations for certain beneficiaries state that the account must be fully distributed within 10-years after the original account owner’s date of death AND that RMDs are required during the 10-year period. The IRS has previously issued Notices regarding the proposed regulations, including waiving penalties for RMDs from inherited IRAs that were not taken in 2021, 2022 and most recently, in 2023. The rules for inherited IRAs are complex and depend on the date of death, whether RMDs had started before the original owner died, the age and relationship of the beneficiary and the type of account.

Energy Efficient Home Improvement Credit

The Inflation Reduction Act of 2022 included new and expanded tax credits for clean energy. The home improvement credit increased from a $500 lifetime credit in 2022 and previous years, to an annual credit of up to $1,200 in 2023, which is available for tax years 2023 – 2033. The credit is 30% of the cost of certain qualified expenditures, with dollar amount caps on most expenditures. The list of expenditures includes exterior doors and windows, central air conditioners, home energy audits and energy property. Certain water heaters, heat pumps, biomass stoves and biomass boilers have a separate annual credit of up to $2,000; therefore, the maximum annual credit available to a taxpayer is $3,200.

Residential Clean Energy Property Credit

The credit is for 30% of certain qualified purchases of energy efficient property used in residential properties. As part of the Inflation Reduction Act of 2022, the credit is extended through tax year 2034, and the percentage decreases incrementally until there is 22% credit for property purchased in 2034, and 0% for property purchased on or after January 1, 2035. The list of qualified property includes solar panels, solar heaters, wind turbines, geothermal heat pumps, fuel cell property and battery storage technology. There is no cap on the dollar limit of the expenditures and the expenditures can be for existing property or for new construction.

New Clean Vehicle Credit

The electric vehicle credit changed to the to the new clean vehicle credit, for vehicles placed into service after January 1, 2023 under the Inflation Reduction Act of 2022. The credit was also expanded to include fuel cell vehicles and used clean vehicles. The credit for new clean vehicles is up to $7,500 and the credit for previously owned clean vehicles is the lesser of $4,000 or 30% of the sales price. The credit is reported in the year that the vehicle is placed in service, which may not necessarily be the same tax year that the vehicle is purchased. The credit is non-refundable and cannot be carried forward, and there are income phase-outs for taxpayers to qualify for the credit. There is extensive information and details about the specific requirements on the vehicles that qualify for the credit. In order to claim the credit, the seller must provide a report to both the buyer and the IRS. Taxpayers can largely rely on the dealer’s information regarding the vehicle qualifying for the credit, and there is information that continues to be updated on IRS.gov.

Forms 1099-K

The American Rescue Plan Act of 2021 changed the reporting threshold for companies to issue Forms 1099-K. Form 1099-K is an IRS informational form, and is issued when a taxpayer receives more than a certain amount in payments for goods and services through a third-party payment network. Prior to 2023, the threshold was $20,000 of payments and more than 200 payment transactions. Starting in 2023, the payment threshold is $600 and there is no minimum of payment transactions. What will change is the vast increase in the amount of Forms 1099-K that are required to be issued for tax year 2023 (received in early 2024). What will not change is the requirement that all income continues to be required to be reported, regardless of whether a Form 1099-K has been issued. What also remains unchanged is that Forms 1099-K are required for payments to purchase goods and services, not for personal payments. So, third-party payment networks such as Venmo, Pay-Pal and Square should not issue a 1099-K when people send money to one another, unless it is to purchase goods and services.

Identity Theft

The IRS will never initiate contact with a taxpayer via e-mail, text or social media. Never respond or click on any links. The IRS will never call taxpayers with threats of being arrested or sued. Beware of providing your tax return or tax data, especially via electronic transmission. Taxpayers can obtain an Identity Protection PIN (IP PIN), which is a 6-digit code issued annually to an individual taxpayer. The code must be included on the tax return and prevents an identity thief from being able to file a fraudulent tax return if the taxpayer has an IP PIN. Always let your tax preparer know of any communication received from the IRS and state taxing agencies to determine appropriate next steps. Go to www.IRS.gov/IPPIN to immediately get an IP PIN.

Please note the purpose of this update is to provide general information and is not meant to offer any specific tax advice. Everyone’s tax situation is unique and should be reviewed with your own tax advisor. We are always available to our clients for questions and to help identify tax planning opportunities.