WHAT ARE THE GENERAL RULES FOR FUNDING ROTH IRAS?

There are three ways to fund a Roth IRA–you can contribute directly, you can convert all or part of a traditional IRA to a Roth IRA, or you can roll funds over from an eligible employer retirement plan.

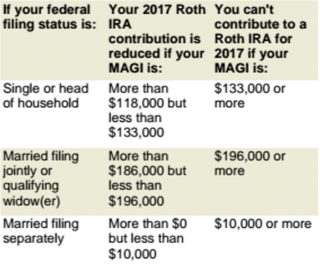

In general, you can contribute up to $5,500 to an IRA (traditional, Roth, or a combination of both) in 2017 ($6,500 if you’ll be age 50 or older by December 31). However, your ability to make annual contributions may be limited (or eliminated) depending on your income level (“modified adjusted gross income,” or MAGI), as shown in the chart below:

Unlike a traditional IRA, you can contribute to a Roth IRA even if you’re 70½ or older. However, your contributions generally can’t exceed your earned income for the year (special rules apply to spousal Roth IRAs).

HOW DO YOU CONVERT A TRADITIONAL IRA TO A ROTH?

Converting is relatively simple. You start by notifying your existing traditional IRA trustee or custodian that you want to convert all or part of your traditional IRA to a Roth IRA, and the custodian/trustee will provide you with the necessary paperwork.

You can also open a new Roth IRA at a different financial institution, and then have the funds in your traditional IRA transferred directly to your new Roth IRA. The trustee/custodian of your new Roth IRA can give you the paperwork that you need to do this. If you prefer, you can instead contact the trustee/custodian of your traditional IRA, have the funds in your traditional IRA distributed to you, and then roll those funds over to your new Roth IRA within 60 days of the distribution.

The income tax consequences are the same regardless of the method you choose.

CALCULATING THE CONVERSION TAX

When you convert a traditional IRA to a Roth IRA, you’re taxed as if you received a distribution, but with one important difference–the 10% early distribution tax doesn’t apply, even if you’re under age 59½.

However, the IRS may recapture this penalty tax if you make a nonqualified withdrawal from your Roth IRA within five years of your conversion. If you’ve made only nondeductible (after-tax) contributions to your traditional IRA, then only the earnings, and not your own contributions, will be subject to tax at the time you convert the IRA to a Roth. But if you’ve made both deductible and nondeductible IRA contributions to your traditional IRA, and you don’t plan on converting the entire amount, things can get complicated.

That’s because under IRS rules, you can’t just convert the nondeductible contributions to a Roth and avoid paying tax at conversion. Instead, the amount you convert is deemed to consist of a pro rata portion of the taxable and nontaxable dollars in the IRA.

For example, assume that your traditional IRA contains $350,000 of taxable (deductible) contributions, $50,000 of nontaxable (nondeductible) contributions, and $100,000 of taxable earnings. You can’t convert only the $50,000 nondeductible (nontaxable) contributions to a Roth, and have a tax-free conversion. Instead, you’ll need to prorate the taxable and nontaxable portions of the account. So in the example above, 90% ($450,000/$500,000) of each distribution from the IRA (including any conversion) will be taxable, and 10% will be nontaxable.

You can’t escape this result by using separate IRAs. Under IRS rules, you must aggregate all of your traditional IRAs (including SEPs and SIMPLEs) when you calculate the taxable income resulting from a distribution from (or conversion of) any of the IRAs. Some experts suggest that you can avoid the pro rata rule and make a tax-free conversion if you take a total distribution from all of your traditional IRAs, transfer the taxable dollars to an employer plan like a 401(k) (assuming the plan accepts rollovers), and then roll over (convert) the remaining balance (i.e., the nontaxable dollars) to a Roth IRA. The IRS has not yet officially ruled on this technique, so be sure to get professional advice before considering this.

FINAL THOUGHTS If it sounds complicated, it’s because it can be. The good news is that your Atlas Wealth Management Advisor can help you navigate the process if it is in your best interest. We covered this topic in detail on a recent client webinar, and will be certain to invite you to our next event.