A health savings account (HSA) is a tax-exempt vehicle that can be used to pay or reimburse certain medical expenses. An HSA can be especially helpful to offset medical costs in retirement, which is usually a retiree’s largest expense.

Eligibility

You must be covered by a qualified high deductible health plan (HDHP) to enroll in an HSA. A qualified HDHP has a minimum annual deductible of $1,350 for self-only coverage or $2,700 for family coverage for 2019. It also has a maximum annual deductible and other out-of-pocket expenses of $6,750 for self-only coverage and $13,500 for family coverage for 2019.1 It is always a good idea to double check with your plan administrator to verify if your plan meets these requirements.

More and more employers are offering these plans and oftentimes include an incentive contribution to the HSA for individuals that enroll.

Before you enroll in a HDHP, determine if it’s right for you. When and how you pay for care are important considerations when choosing between traditional health plans and HDHPs:

- Would you rather pay higher monthly premiums and fixed copays for office visits and prescriptions, or pay lower premiums and be responsible for covering the cost of office visits and prescriptions?

- How often do you visit your doctors? Specialists? How many prescriptions does your family use and how expensive are they?

Additionally, if you and your spouse/domestic partner are covered by an HDHP with an HSA, neither of you can contribute to a healthcare flexible spending arrangement (FSA). You can, however, enroll in a limited purpose FSA, generally restricted to dental and vision expenses, as well as a dependent care FSA for daycare expenses. The rules can get tricky if you and your spouse/domestic partner have separate coverage, so it is always important that you are coordinating your coverage. If you have any questions on how these rules may impact your situation, give your Atlas Wealth Management Advisor a call to discuss.

Potential tax savings

HSAs are becoming increasingly popular as a medical and retirement savings vehicle as they have the potential to provide multiple federal tax benefits:

1. Contributions are made on a pre-tax basis. If you enroll through your employer, you can contribute on a pre-tax basis through payroll deductions. The IRS sets annual limits each year. Additionally, individuals that are age 55 or older by the end of tax year can contribute a $1,000 catch-up. These contributions are also exempt from Social Security and Medicare taxes.

To incentivize employees to use these accounts to save money, employers may also make contributions toward the HSA. Keep in mind that their contributions will count toward the annual limit. An employer may deposit their contributions to an employee HSA, by lump sum at the beginning of the year or as a match made over the course of the year.

2. Earnings grow tax-free. Many HSAs offer the opportunity to place funds over a certain amount (often $1,000 or $2,000) in a variety of savings and/or investment options.2 Some employers provide a pre-selected list of options while others provide access to a broad range of options.

3. Withdrawals for qualified medical expenses are tax-free. You can use your HSA funds to pay for out-of-pocket expenses that go toward your annual deductible, such as doctor visits, prescriptions, lab tests, hospital stays, and more.3 Less commonly known is that you can pay a portion of qualified long-term care insurance, Medicare, and COBRA premiums using your HSA funds (for these, limits or conditions may apply).4

Also, don’t forget to save your receipts. If you don’t have the funds available in your HSA at the time your eligible medical expense is incurred, you can pay out-of-pocket now and reimburse yourself at a later date.

How does an HSA stack up to an FSA?3,4

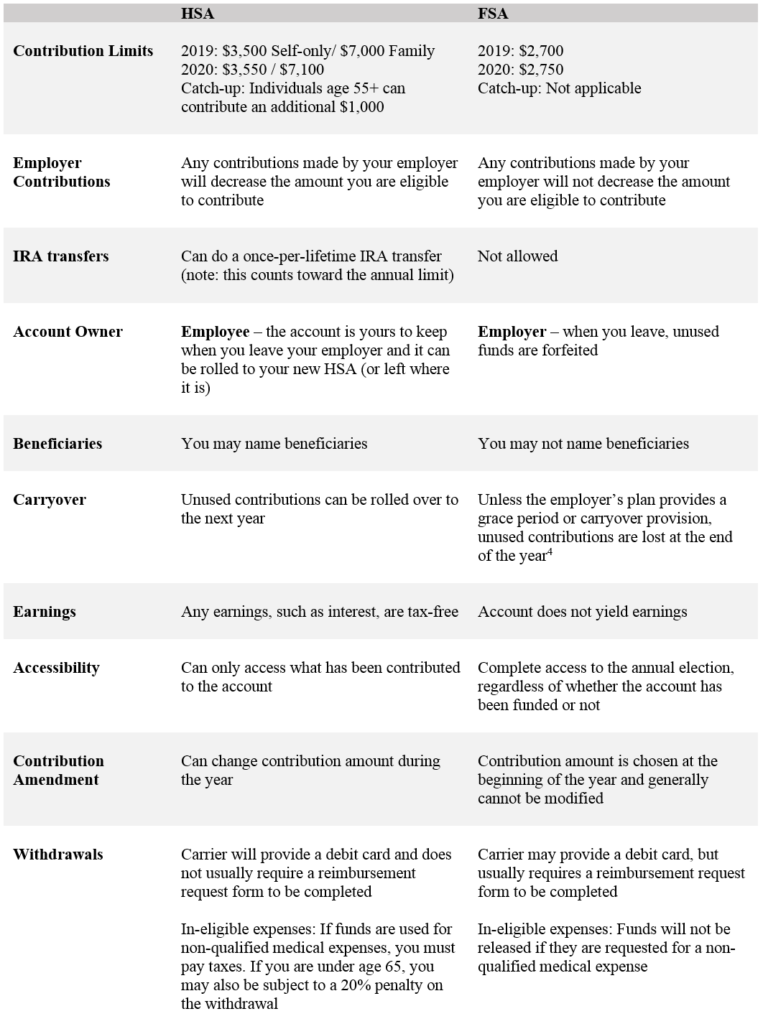

HSAs are relatively new compared to their cousin, FSAs. HSAs can be paired only with high deductible health plans (HDHPs), whereas a healthcare FSA can only be utilized if enrolled in a traditional medical plan (such as a health maintenance organization (HMO), point of service (POS), or exclusive provider organization (EPO)). The following table highlights the main differences between the two:

Common oversights

HSAs have the potential to provide long-term savings and tax benefits similar to employer-sponsored retirement plans and individual retirement plans (IRAs). The following are common pitfalls that lead individuals to overlook or underutilize these accounts.

Not coordinating with Medicare. More and more people are working past the age of 65. When you enroll in Medicare you are no longer eligible to contribute to an HSA. Although you are eligible for Medicare at age 65, you do not need to enroll until after you retire as long as you are working for a large employer (20+ employees) and are still covered by their healthcare.

Forgetting it’s a long-term savings vehicle. If you have the ability to cover your current out-of-pocket medical expenses, try not to deplete your HSA each year. You can let your HSA grow now and save the receipts and pay yourself back later. Individuals nearing retirement may not think it’s worth saving for just a couple years, but they should keep in mind the tax savings.

Thinking it might be too late to save. If you forget to make a contribution for the year, you have until the tax filing deadline (excluding extensions) to add to your account.

Not realizing your spouse can also save on a catch-up basis. If your covered spouse is 55 or older, they can open their own HSA (if they don’t already have one) and contribute the $1,000 catch-up.

During the fall, many companies have an open enrollment for healthcare and other benefits. If you have any questions or concerns, please do not hesitate to reach out to your Atlas Wealth Management Advisor. We’d be happy to discuss your benefit options.