As we move toward spring, we hope that you are well and looking forward to an active and healthy summer. We at Atlas have had a busy winter. With markets showing resilience and an economy that is moving along better than many expected, we are optimistic that we could see continued economic growth through 2024.

THE CONSENSUS CAN BE WRONG…

As you may recall, heading into 2023 the consensus among investors seemed to be that we would fall into a recession sometime during the year. To the contrary, as we pointed out in the last update, through the first three quarters of the year we saw strong economic growth. As we later learned, the fourth quarter of 2023 continued the growth trend with GDP of 3.2% (revised down from the Commerce Department’s initial estimate of 3.3%). These unexpectedly strong economic conditions were accompanied by a decrease in the rate of inflation throughout the year. The first quarter of 2024 saw GDP growth of only 1.6%, but also saw an unexpected uptick in inflation. This left the Fed in the position of not wanting to cut rates as soon as had been forecast, and as we move further into 2024 many investors are asking when and if rates will be cut.

… AND BANKING ON IT CAN BE RISKY

Navigating this environment can be difficult for individual investors. 2023 surprised to the upside, and anyone that shifted to a defensive posture early missed out on attractive market returns. According to Morningstar, the fully allocated 60/40 (stocks %/bonds %) portfolio returned about 15.5% in 2023, above its’ long-term average. Conversely, there have been many periods when an overly aggressive approach has been penalized.

We continue to practice an investment methodology with its’ foundation based in Modern Portfolio Theory, emphasizing the careful identification of a proper risk-based allocation, rebalancing when needed and maintaining a focus on an appropriate investment horizon. Some investors may be more driven by headlines and near-term projection, but the academic research suggests that maintaining a focus on the longer term reduces risk and leads toward better investment outcomes.

THE VALUE OF PROFESSIONAL MANAGEMENT

That said, we believe professional Asset Managers can be valuable to individual investors in several ways:

- Evaluating the economic climate and working to identify major investment implications,

- Prospectively valuing various investment opportunities,

- Making the most of an extensive network of data and experience to determine vehicles for investment,

- Determining appropriate risk-level based allocations to investments, and

- Providing useful updates and information that allow investors to better understand what they own.

Focusing on just the first two of our five aims – the economic outlook and identifying the most important themes we believe will drive returns in 2024, we have the following observations.

While many economic indicators currently indicate strong performance, we are watchful for any signs of slowing. Currently, economic growth seems solid, unemployment remains low, and while according to the Institute for Supply Management U.S. manufacturing levels could improve, the larger services sector of the economy continues to grow nicely. More recent numbers on consumer activity raise some caution, but that has not yet taken hold in economic terms. Importantly, inflation growth continues to trend down. All of the mentioned factors lead us to the conclusion that the U.S. Fed can wait longer than markets have anticipated to lower interest rates, which has historically been a good thing.

HISTORICALLY, LONGER FED PAUSES HAVE GENERALLY PRODUCED GREATER RETURNS

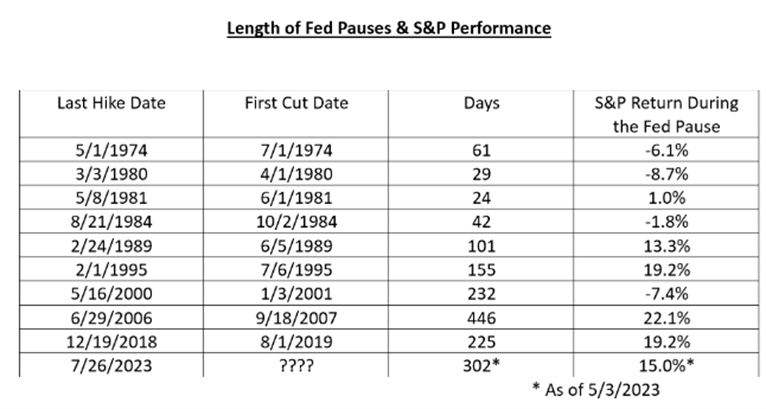

Looking at previous periods when the Fed was on hold shows that the current pause ranks fourth in terms of duration, but if the Fed remains on hold through March it will jump to second. The positive view on this is that the longer they hold, the more the market has historically inched higher. In periods where the pause is greater than one hundred days, the market is up on average 13% compared to when the pause is less than one hundred days and the market on average is down. The best performance occurred during the 2006/2007 pause which was the longest and resulted in the S&P rising 22%.1 (Chart data obtained from Strategas Research Partners)

Accordingly, we continue to think that U.S. equities are priced just slightly above fair value, having room to run (the concept of “fair value” is largely only useful in a theoretical context to the extent to which the market so rarely reflects it, and it can so often be subjective.)

In our view, with analysts currently forecasting earnings to grow almost 11% this year, the S&P trading at 19.2x forward earnings expectations, and market participants expecting cuts in the Fed Funds rate, a strong case for excessively widespread gains in the Index is difficult to construct. We do believe however that certain themes such as the growth of Artificial Intelligence and progression within the area of Cyber Security and communications technology could provide meaningful opportunities.

IF YOU’RE NOT UP ON ARTIFICIAL INTELLIGENCE, YOU’RE NOT ALONE…

But like it or not, Artificial Intelligence (AI) is upon us and it appears it is here to stay. The pace and the impact of AI on business processes may require years to fully discern. Still, there is no denying that the excitement regarding this relatively new technology is having an outsized impact on the performance of the so-called Magnificent Seven (Apple, Amazon, Alphabet/Google, Microsoft, Meta, Nvidia and Tesla), although only Microsoft, Google and Nvidia could be considered pure-plays on the theme. If it were its own sector, the Magnificent Seven would constitute 29% of the S&P 500 Index’s market capitalization but only 20% of its’ expected earnings in 2024. At moments in 2023, a majority of the performance of the S&P 500 was attributable to these few stocks. Having said that, the earnings growth of these stocks is incomparable to anything one can see in the rest of the market.

We think that maintaining a nimble approach will be necessary to provide robust real returns this year. But as they say in sports, “that’s why they play the game.” We’ll find out together.

As always, we at Atlas remain focused on these issues, and are watchful for any opportunities that may result. If you have any questions about this or any other financial matter, please feel free to contact your Atlas Wealth Management Advisor. We are readily available to serve you.

Sources: Morningstar, Institute for Supply Management, U.S. Department of Commerce, Bureau of Economic Analysis, Strategas Research Partners, FactSet Business Data and Analytics.

Footnotes and Sources

[1] Strategas – Long Fed Pauses Historically Better For S&P Returns – The Daily Macro Brief February 7, 2024. *Updated May 3, 2024.