In movies, novels, and even in real life, there are those who dedicate their life’s work to searching and discovering. Whether the search is for sunken treasure, the fountain of youth, a spiritual vortex, a cure for cancer, or the Holy Grail, there must be a calculated plan in place—a map to help guide you to your destination. In the same manner, the path to retirement can be fraught with pitfalls and dangers, but if you plan properly and have the right strategy, you can get there! But it doesn’t just happen. It absolutely takes time and effort on your part.

There was a time when most financial advisors talked to clients about the “three-legged stool” as a part of retirement planning. Historically, the legs have been a pension benefit, a Social Security benefit, and your savings and investments. What if you don’t have a pension? That doesn’t mean you can’t retire. It just means that your savings and investments must be able to compensate for the missing leg. As of 2019, only 14% of Fortune 500 companies offered a traditional or hybrid (cash balance) defined benefit pension plan to its new hires, according to a Willis Towers Watson report. That’s a dramatic drop from the 59% of that same group offering pensions in 1998.1

And what if you’re young? We often hear young people say they don’t plan on ever receiving Social Security. Well, they’re still going to retire. They’ll just have to shoulder more of the burden of providing income. The saving and investments leg of their three-legged stool will have to be as big as the three legs of the traditional three-legged stool combined. A 2023 report from the Social Security Administration shows that, as a whole, Social Security is fully funded until 2034, and after that, it is about three-quarters financed.22

Your #1 Priority—Map Out the Path!

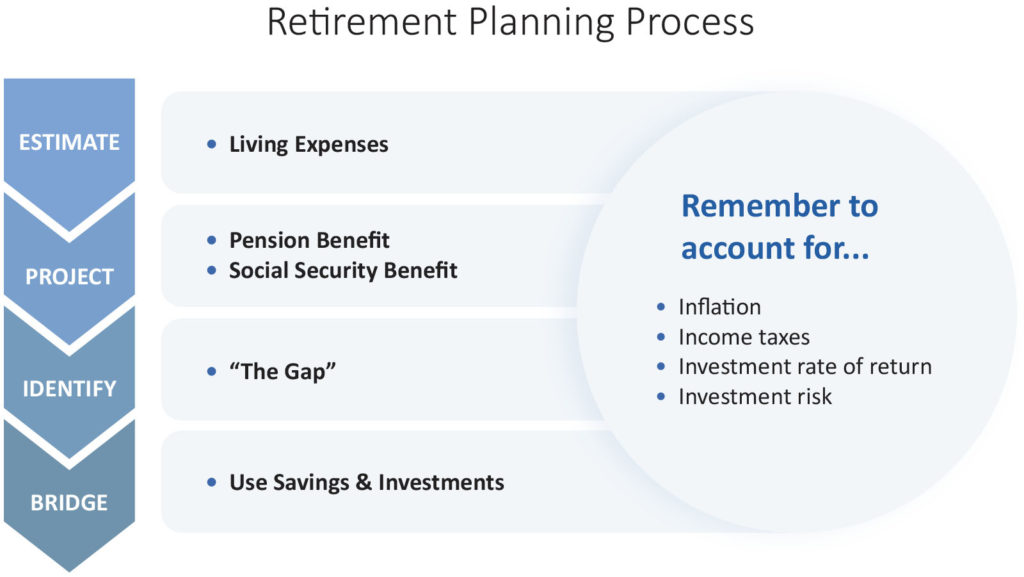

As with all missions, you have to determine your goal or destination first and then figure out how to get there. Perhaps, you want to retire at 55, 60, or 65. Are you flexible on the date or firm? The next step is to figure out how much it costs to live today. This will provide the basis for how much income you‘ll need in retirement.

Where Can I Make a Difference?

Pension and Social Security benefits are typically based on the amount of your income, the number of years you work, and when you commence your benefit. So, the longer you work, the later you commence your benefits, the greater your income should be. You can make the greatest impact on your path to retirement with your personal savings and investments. It is paramount to focus on your savings rate and investment allocation in your 401(k), 457, 403(b) plan, IRA, or Roth IRA.

Choose Wisely

In the movies, novels, and even in research, periodically there are warnings along the way. As you determine where to save for retirement, you should first consider your employer-sponsored retirement plan, especially if your employer matches your contributions. Even without a match, an employer-sponsored plan can significantly help with your savings efforts. Payroll deductions are an easy way to save regularly. The ability to save pre-tax or Roth, if your plan allows, can provide valuable tax benefits too. If you don’t have an employer-sponsored retirement plan, you should use your own IRA—Roth or Traditional—depending on what’s right for your circumstances.

If you’re 30 years old, planning to retire in 30 years, and you save $100 each week, you can accumulate approximately $361,700, assuming there’s a 5% rate of return. If you increase your weekly contribution by $10 each year over the 30 years, your accumulation will be approximately $742,500—105% more.3 So small changes can have a significant impact over a career of work.

Choose Wisely, Again!

The investment decisions that you make for your retirement savings can have a dramatic effect over long periods of time. Again, if you’re 30 years old, planning to retire in 30 years, and you save $100 each week (without the annual increases discussed above), your account balance should be approximately $301,400, assuming a 4% rate of return (almost double the amount you contributed). Remember, at 5%, the balance after 30 years was $361,700. But if your account earns 7%, your account balance at year 30 is almost $531,500.3

What happens if we add a $10 annual increase to your $100 weekly contribution? With a 7% average annual rate of return, the account balance after 30 years is just over $1 million!3

I Don’t Have That Much Time

Sometimes timing is everything. A research protocol change or a wrong turn on a trip can hinder forward progress. Well-timed decisions can help you side-step retirement planning pitfalls. Even if you’re less than 30 years from retirement, you can still make a difference and turn your retirement into a success. After reviewing your retirement analysis, if you find that the results are not as good as you expected, you’ll have to decide which well-timed actions to take.

- Keep working for a few more years and retire later

- Lower your standard of living and spend less

- Save more between now and retirement

- Take on more investment risk, and, hopefully, increase your rate of return

And, perhaps, it’s some combination of these actions that will be the most palatable for you and your family.

Healthcare Considerations

Since ancient times, people have searched fruitlessly for the fountain of youth. Until there’s success, there’s no denying that we need health insurance and a way to pay for it. Whether your plan includes retiring before or after age 65, be sure to include the cost of health insurance as an expense. You should be aware that Medicare premiums are based on your income. The higher your income, the more expensive your premium can be.

A Health Savings Account (HSA) is an opportunity that may be available to you

A Health Savings Account (HSA) is an opportunity that may be available to you. If you participate in an eligible high-deductible healthcare plan, you can also contribute to an HSA. In 2024, these accounts allow you to make pre-tax contributions of up to $4,150 if you have individual coverage and $8,300 if you have family coverage. If you’re 55 or older, the 2024 limits are $5,150/individual and $9,300/family.4

- Contributions are exempt from federal, state, and certain payroll taxes like Social Security and Medicare tax

- Earnings in the account are tax-free

- Qualified distributions used to pay eligible medical expenses are tax-free

Once you reach age 65, you can still take tax-free distributions to pay for qualified medical expenses. You can also take tax-free distributions to pay for Medicare premiums. If you choose to take a distribution that is not used for qualified medical expenses, it will be taxable but not subject to any penalties.

The Strategy: If you’ve made the maximum contribution to your company’s 401(k) plan and are participating in an eligible high-deductible healthcare plan, consider maximizing your HSA contribution.

Getting There Successfully

As you prepare for retirement, consider getting help from your Atlas Wealth Management Advisor. He or she can work with you to identify your goals, needs, and aspirations, and help you choose and implement financial strategies to pursue your particular goals and needs given your risk tolerance and time horizon. At any stage of your career, it’s important to consult with an expert. We’re here to answer any questions you may have about your retirement plan.

What Else?

Atlas helps individuals with their retirement and other financial planning needs. But did you know that we also provide services to assist businesses in the administration of their retirement plans? Does your company have a 401(k) or a similar retirement plan? Your plan might benefit from an Atlas review. Perhaps we can help your business enhance the participant experience.

Revised 12/21/2023

- “Retirement offerings in the Fortune 500: A retrospective”; Brendan McFarland, Volume 30, Number 6, June 2020. ↩︎

- “Treasury Releases Social Security and Medicare Trustees Reports.” U.S. Department of the Treasury, 31 Mar. 2023, home.treasury.gov/news/press-releases/jy1381. ↩︎

- Each of these returns is based on weekly compounding. ↩︎

- IRS Publication 969, Health Savings Accounts and Other Tax-Favored Health Plans, March 2019. ↩︎