Age 65… often times reaching this milestone gives you more access to discounted theatre tickets or special offerings. Perhaps, the freedom to travel a bit more and time to enjoy hobbies or new activities. Years of work and various sacrifices… and here you are stepping into an exciting chapter: In all likelihood, you are eligible for Medicare.

We regularly receive questions as clients transition into Medicare eligibility. Many questions arise during enrollment periods and when you may be faced with coverage changes. Whether you are newly eligible, reviewing your annual options, or helping parents or friends navigate health care questions, we wanted to share some knowledge that might help.

Please use the summary and resources provided and linked below as a guide for general circumstances and bring additional questions and concerns to your Atlas Wealth Management Advisor.

65 is here… I am Medicare eligible… what else should I know about enrolling?

Your typical enrollment eligibility begins 3 months before you turn 65 and ends 3 months after you turn 65. Exception, if your birthday lands on the first of a month your initial enrollment period begins 4 months before you turn 65 and ends 2 months after.

Premium-free Medicare Part A “hospital insurance” coverage starts the month you turn 65, if your birthday lands on the first of the month your coverage starts the month before you turn 65. For Medicare Part A to cover hospital, hospice, home healthcare, or inpatient treatment, a doctor must confirm that the treatment/services are required.

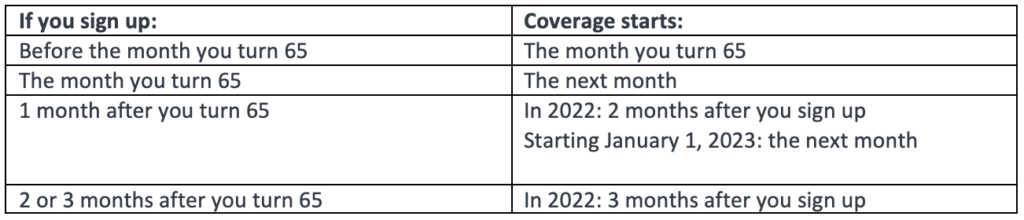

Medicare Part B/ Premium-Part A coverage commencement is determined by your enrollment date. Medicare part B is also known as “medical insurance”. Some of the health/preventative care services Part B covers include doctor visits, DME (durable medical equipment), bloodwork and labs, mental health and substance abuse treatment, and outpatient procedures. As a general rule, your coverage for these plans will never start before you turn 65. Note the current coverage rule has been streamlined and will take effect beginning January 1, 2023.

Please see the chart below from medicare.gov for illustration for Medicare Part B/ Premium-Part A. [i]

Are there any disadvantages to Medicare?

As with most things, it is good to understand the potential downsides. For one, if you have an HSA, enrolling in Medicare makes you ineligible to contribute to your HSA since Medicare is not considered an HDHP. It is illegal to make contributions to an HSA once you have enrolled.

Are there any services not covered by Medicare Parts A & B?

Similar to other medical insurance, treatments or surgeries that could be considered cosmetic might fall outside the realm of your coverage under Medicare Part A and B. Some examples of this could be…

- Eye exams for prescription lenses

- Hearing aids

- Dental

- Prescription drugs

- Acupuncture

Follow the link to understand more about Medicare Part A and B https://www.healthline.com/health/medicare/medicare-part-a-vs-b

What is a Medicare Advantage Plan?

Medicare Advantage Plans sometimes referred to as “Part C” or “MA Plans” are offered by Medicare-approved private companies that must follow rules set by Medicare. Some of these plans include drug coverage “Part D.”

Typically, these plans are offered at a higher cost, but they also set a limit to what you must pay out-of-pocket and may even offer non-emergency out-of-network coverage.

Much like other alternative plans mentioned not all plans work the same way, and you should compare plans to make sure you are getting the coverage that best meets your unique needs.

For more information about Medicare Advantage plans continue here https://www.medicare.gov/Pubs/pdf/12026-Understanding-Medicare-Advantage-Plans.pdf

What is Medigap?

Medigap is a form of supplemental insurance sold by private companies that can be used in conjunction with Medicare Parts A and B to fill gaps in coverage. A few examples would be deductibles, coinsurance, and copays.

Note, YOU MUST HAVE Medicare Part A and Part B to qualify for a Medigap policy and this policy will come with its own premium to pay.

Learn more about Medigap policies here https://medicare.healthinsurance.com/learning-center/article/medicare-supplement-101

What if I am still working past 65? Can I still get Medicare?

The biggest determining factor is how your current health insurance plan works and the number of employees you (or your spouse) currently work with.

When you or your spouse have employer-based health insurance through a job, neither of you may need to sign up for Medicare while you are still working. You can likely wait until your coverage expires or you or your spouse stops working but you should confirm with your current plan administrator/insurance provider given the particulars of your personal situation.

If your employer has less than 20 associates or you are using a COBRA Plan, and you are turning 65, you should check with your plan administrator/insurance provider to confirm your coverage parameters and sign up for Medicare in a timely fashion to avoid gaps in your employer-sponsored coverage.

If you are self-employed or have alternative health insurance not offered to all associates in the company you work for, you should contact your insurance provider to confirm that your plan’s coverage is an employer group health plan. In this instance, if you are informed that you are not in fact in an employer group health plan, you should begin your sign-up process for Medicare to avoid Part B late enrollment penalties as early as three months before your 65th birthday.

An 8-month Special Enrollment window exists when you stop working. During the 8 months following the end of your employment, you can enroll in Medicare Part A & B, without penalties.

Learn more about Medicare enrollment while working https://www.retireguide.com/medicare/eligibility-and-enrollment/while-working/

How often do Medicare IRMAA rates change? Can I fight it if I think it is inaccurate?

Income Related Monthly Adjusted Amount (IRMAA) surcharge rates and Modified Adjusted Gross Income (MAGI) thresholds are announced in mid-October, so please stay on the lookout for those. Keep in mind that the final breakpoints do not take effect until January 1. One thing that has remained the same is that the government will still use your 2021 MAGI to determine your potential surcharge in 2023. If you believe that your surcharge seems grossly or noticeably inaccurate there are circumstances that must exist for you to qualify for an appeal. Some examples would be…

- Retirement

- Divorce

- Marriage

- Loss of certain pension income

Learn more about IRMAA – https://www.medicareresources.org/medicare-eligibility-and-enrollment/what-is-the-income-related-monthly-adjusted-amount-irmaa2/

Once I am enrolled in Medicare, am I all set annually?

Yes and no. Similar to active group medical plans or car insurance, your Medicare plan automatically renews unless you change it, allow it to lapse due to lack of payment, or a qualified life event occurs that impacts your eligibility. It is, however, very good to review the benefits offered for the upcoming plan year as providers and insurance companies re-assess and renegotiate Medicare Plan benefits annually.

Atlas will always recommend taking the position of active management and making time to review and confirm that your plan will continue to meet your needs in the following year. For example, the cost could go up or, alternatively, the coverage you need isn’t available under the current plan you have. Check your Medicare plan and consider your personal healthcare needs. If your current plan does not cover your current or progressive needs then shop for a plan that better suits your needs.

For additional resources you can review the “Medicare & You” handbook that is updated annually.

Continue to the links below for the “Medicare & You handbook” and more on why reviewing your Medicare plan annually is important

https://www.medicare.gov/medicare-and-you?WT.mc_id=8031053

https://www.medicareadvantage.com/enrollment/review-your-medicare-plan

Always protect yourself – You are always your first defense against fraud

As in all instances, be mindful of protecting your personal information. DO NOT GIVE personal information to plan callers. Medicare product servicers are not allowed to call you to enroll you into a plan UNLESS you specifically ask to be contacted.

No one should call you without your permission or come to your home without invitation to sell Medicare products. Call 1-800-MEDICARE to report a plan that does this. Continue here to learn more about how to prevent Medicare fraud and abuse.

Find a Medicare specialist from your state

For additional resources visit…

https://www.agingcare.com/articles/preparing-for-the-medicare-open-enrollment-period-208377.htm

https://www.medicarefaq.com/faqs/medicare-annual-enrollment-period/

[i] Welcome to Medicare | Medicare_ https://www.medicare.gov/